owe state taxes from unemployment

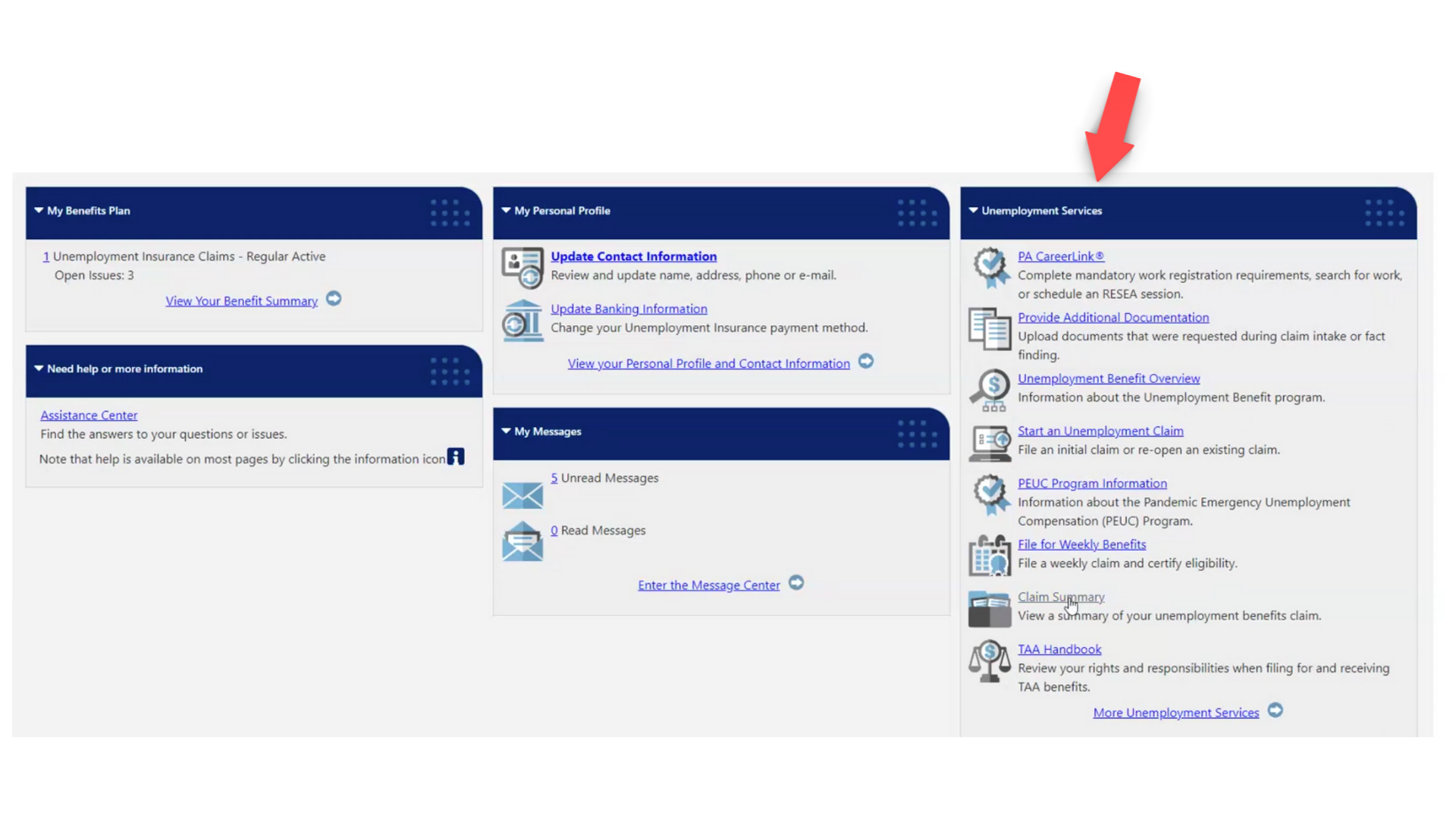

This may result in benefit payment taking longer to process but you. If you owe previous taxes the IRS might already be looking at your file.

Here S Information On Why Unemployment Is Taxable In Colorado 9news Com

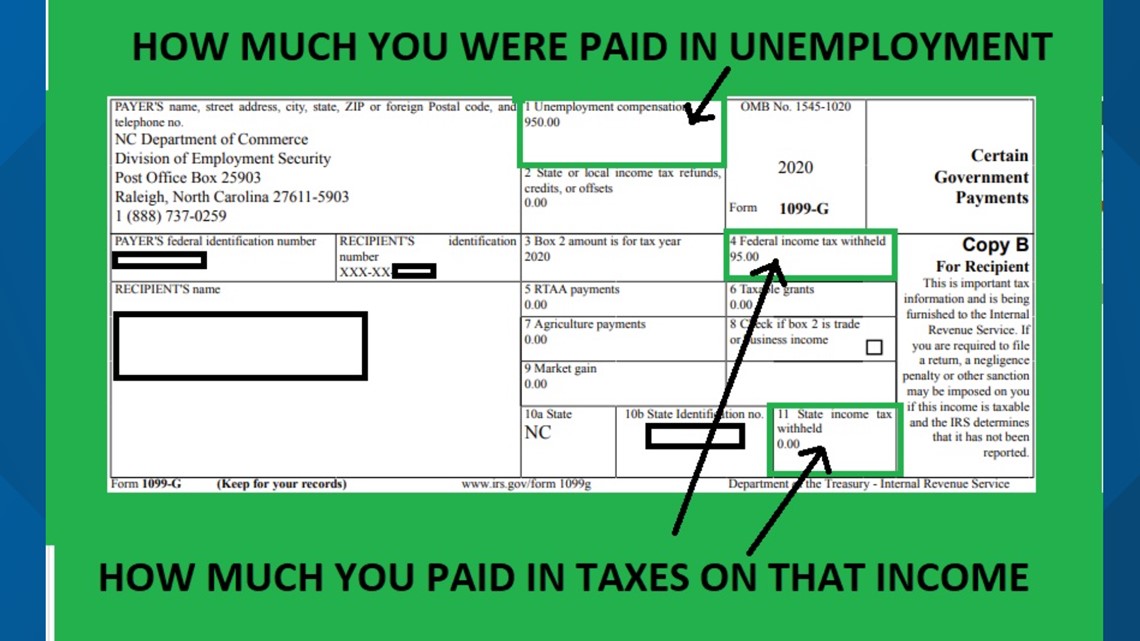

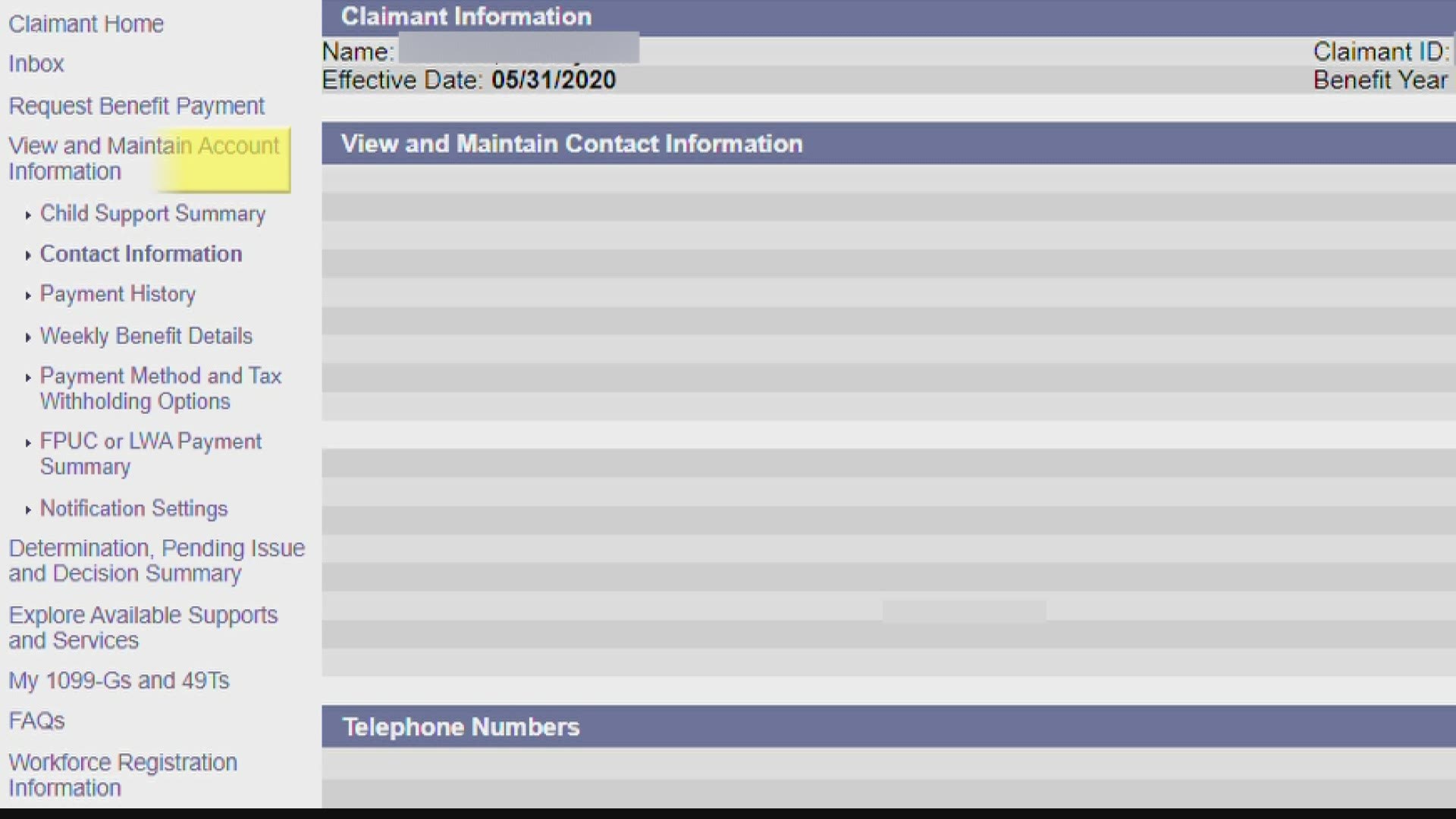

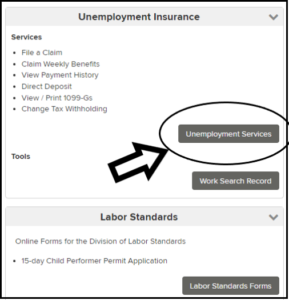

You should receive a 1099-G reporting the unemployment.

. As for state taxes on. January 27 2021 753 AM. The last thing most people want or need is to get audited.

According to Experian you could be taxed federally on your unemployment insurance anywhere from 0 to 37 percent. Typically employers and employees each pay 62 in Social Security tax and 145 in Medicare tax but you wont owe this on your unemployment income. Workers without a qualifying child.

The unemployment exclusion specifically said you didnt have to pay taxes on the first 10200 of unemployment compensation drawn in the year 2020. If you did not pay enough taxes on your unemployment during the year you may have to pay additional taxes on it when you complete your tax return. And sometimes they dont benefits.

Both the state unemployment tax and withholding tax should generally be paid to the employees work state but there are exceptions. When Gale Nichols received her tax forms last month she was in shock. The IRS considers unemployment benefits taxable income When filing this spring your unemployment checks from 2021 will be counted as income taxed at your regular.

At the federal level thats also true. According to the IDOR the earned income tax credit can mean up to a 6660 refund when a taxpayer files a return with qualifying children. Even though she opted to have California withhold 10 of her unemployment benefits.

Previous Owed Taxes Can Cost You. Some states that border each other have. We have the authority to seize your real estate and personal property such as automobiles and business assets in order to collect past due tax penalty and interest.

Unemployment checks dont have taxes withheld which leads most people to believe that they wont owe taxes on them come April 15th. However we will notify. Unemployment compensation is taxable income which needs to be reported by filing an income tax return.

In observance of the state and federal holiday IDES offices will be closed on Monday September 5th.

I Got Unemployment In Florida How Will My Taxes Be Affected Firstcoastnews Com

Did You Collect Unemployment Benefits In 2020 Act Now To Avoid A Tax Day Surprise Dollars And Sense Abc10 Com

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Can The Irs Take Or Hold My Refund Yes H R Block

How Will Unemployment Benefits Impact Your 2020 Taxes Legalzoom

How Is Unemployment Taxed Forbes Advisor Forbes Advisor

Unemployment And Withholding Taxes Homeunemployed Com

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

Get Ready To Owe Lots In Taxes Over Covid 19 Unemployment Benefits Iheart

Taxes Q A How Do I File If I Only Received Unemployment

You May Owe Taxes On Those Unemployment Benefits

Last Year S Unemployment Benefits Could Cost Americans 50 Billion At Tax Time Cbs News

Americans Could Owe 50b In Taxes On Unemployment Benefits This Year Fox Business

Unemployment Benefits Tax Issues Uchelp Org

Americans Could Owe 50b In Taxes On Unemployment Benefits This Year Fox Business

Will You Owe Taxes On Your Unemployment In 2022 Five Things You Must Know Irs Enrolled Agent Talks Youtube

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill